Financial due diligence (FDD) is a comprehensive evaluation of a company’s financial health, conducted before engaging in significant transactions such as IPOs, mergers, acquisitions, or investments. This process involves scrutinizing financial statements, assessing assets and liabilities, and understanding cash flows to ensure informed decision-making and risk mitigation.

Businesses conduct financial due diligence before making major financial decisions, such as investments, mergers, acquisitions, or partnerships. It is a thorough investigation of a company’s financial health to ensure there are no hidden liabilities. Careful evaluation helps you to make an informed decision and avoid unexpected problems.

Why is Financial Due Diligence Important?

Financial due diligence (FDD) helps businesses identify potential financial risks, validate financial statements, & ensure that they are making sound investment decisions.

Here’s why it is crucial:

- Risk Identification: Uncovers hidden debts, liabilities, or financial inconsistencies that could impact profitability.

- Valuation Accuracy: Ensures the business is valued correctly and prevents overpayment.

- Regulatory Compliance: Checks whether the company adheres to financial and tax regulations.

- Strategic Decision Making: Provides a clear picture of financial strengths and weaknesses.

- Investment Protection: Helps investors safeguard their money by assessing financial sustainability

The Process of Financial Due Diligence: The due diligence process typically involves:

- Reviewing Financial Statements: Examining past financial records (balance sheets, income statements, cash flow statements) to assess profitability and revenue trends.

- Assessing Liabilities: Checking outstanding debts, pending lawsuits, and tax obligations.

- Evaluating Revenue and Profit Margins: Analyzing how the company generates profits and whether they are sustainable.

- Analyzing Cash Flow: Ensuring the business has healthy cash flow to meet operational needs.

- Industry and Market Position Analysis: Comparing financial performance with competitors and understanding market risks.

Company A either negotiates a better deal, demands corrective actions, or walks away from the transaction to avoid financial loss.

Let’s Understand by Zomato – Blinkit’s Merger & Acquisition

A recent example is Zomato’s acquisition of Blinkit (formerly Grofers). Before acquiring Blinkit, Zomato conducted financial due diligence to assess the company’s revenue model, debt obligations, and market potential. By evaluating Blinkit’s financial health, Zomato ensured that the acquisition aligned with its long-term business strategy. This due diligence process helped Zomato mitigate financial risks and make an informed investment decision.

Benefits of Financial Due Diligence

- Prevents Financial Loss: Identifies financial risks that could lead to losses.

- Ensures Transparency: Provides accurate insights into a company’s true financial condition.

- Facilitates Better Negotiations: Helps buyers and investors negotiate better terms.

- Strengthens Investor Confidence: Investors feel more secure when they have a clear understanding of a company’s financial health.

- Regulatory Compliance: Ensures adherence to tax and legal requirements, avoiding legal troubles.

Conclusion

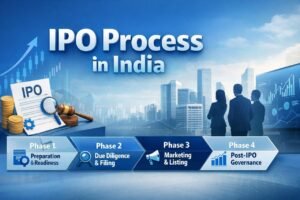

Financial Due Diligence is an essential risk-management tool for businesses and investors. Whether you’re investing in a company, acquiring a business, or preparing for an IPO, due diligence ensures that your financial decisions are backed by verified data. It minimizes risks, improves deal transparency, and enhances investor confidence. If you’re considering an investment or a business transaction, connect with financial experts to ensure financial clarity and confidence in your deals.

This blog has been thoughtfully curated by Mr. Pradip Agrawal, President – FRA, Gretex Corporate Services Limited, leveraging his deep industry expertise to guide businesses through critical financial transitions