Initial Public Offering(IPO)

About IPO

As per the official estimates, there are about 63.05 million micro industries, 0.33 million small, and about 5,000 medium enterprises in the country. Since MSMEs forms such a large part of our economy, the proper functioning of such enterprises is necessary. Most of the MSMEs are dependent either on their personal finance or on Bank finance. Most MSMEs have leveraged themselves with the Bank and financial institution to the extent that the burden of the finance cost affects the growth of the company and acts as a hurdle in the company’s growth potential. To tackle this, the company shall break the stereotypes and shall look raise funds through the capital market.

An MSME company can dilute its equity and raise capital through Equity Market. Raising through equity market capital has no interest cost and the company has doesn’t have to pay any service cost for such capital. MSMEs can use the capital market to raise funds and expand their company in a cost-effective manner.

Role of Gretex in IPO

Gretex will act as Lead Manager to the issue, we are responsible to complete the entire listing process. The process can be classified as below;

1. Pre – Issue: The lead manager takes up the due diligence of the company’s operations/ management/ business plans, etc and additionally drafts as well as design offer documents, prospectus, statutory advertisements, and memorandum of association. The lead manager shall ensure compliance with the stock exchanges, RoC, and SEBI including finalization of prospectus and RoC filling.

2. Post – Issue: The lead manager also draws up various marketing strategies for the issue. Post issue activities include management of escrow accounts, dispatch of refunds, finalization of trading and dealing of instruments, Submission of final offer document with ROC / SEBI and Stock Exchanges, Completion of Issue and allotment process and Listing of Shares on Stock Exchange, etc.

SME IPO

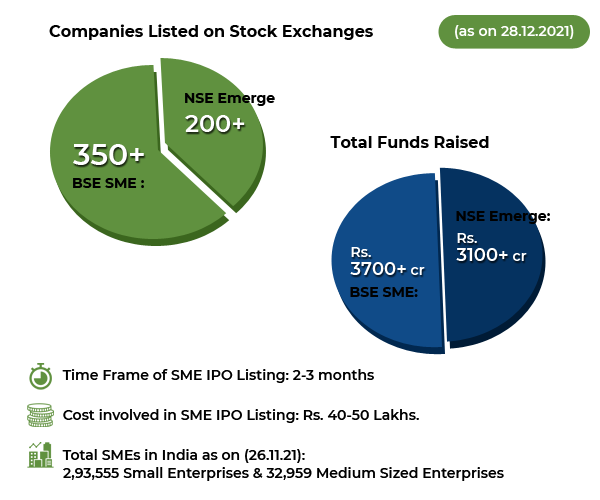

- Time Frame of SME IPO Listing: 2-3 months

- Cost involved in SME IPO Listing: Rs. 40-50 Lakhs.

- Total SMEs in India as on (26.11.21): 2,93,555 Small Enterprises & 32,959 Medium Sized Enterprises

Mainboard IPO

- Time Frame of Mainboard IPO Listing: 6-9 months.

- Cost involved in Mainboard IPO Listing: Rs. 400-500 Lakhs.

SME IPO

As per the official estimates, there are about 63.05 million micro industries, 0.33 million small, and about 5,000 medium enterprises in the country. Since MSMEs forms such a large part of our economy, the proper functioning of such enterprises is necessary. Most of the MSMEs are dependent either on their personal finance or on Bank finance. Most MSMEs have leveraged themselves with the Bank and financial institution to the extent that the burden of the finance cost affects the growth of the company and acts as a hurdle in the company’s growth potential. To tackle this, the company shall break the stereotypes and shall look raise funds through the capital market.

An MSME company can dilute its equity and raise capital through Equity Market. Raising through equity market capital has no interest cost and the company has doesn’t have to pay any service cost for such capital. MSMEs can use the capital market to raise funds and expand their company in a cost-effective manner.

Mainboard IPO

Role of Gretex in SME IPO/Mainboard IPO

Gretex will act as Lead Manager to the issue, we are responsible to complete the entire listing process. The process can be classified as below;

1. Pre – Issue: The lead manager takes up the due diligence of the company’s operations/ management/ business plans, etc and additionally drafts as well as design offer documents, prospectus, statutory advertisements, and memorandum of association. The lead manager shall ensure compliance with the stock exchanges, RoC, and SEBI including finalization of prospectus and RoC filling.

2. Post – Issue: The lead manager also draws up various marketing strategies for the issue. Post issue activities include management of escrow accounts, dispatch of refunds, finalization of trading and dealing of instruments, Submission of final offer document with ROC / SEBI and Stock Exchanges, Completion of Issue and allotment process and Listing of Shares on Stock Exchange, etc.

Role of Gretex in IPOs

Pre-Issue:

- Checking the Eligibility Criteria.

- Due diligence of Company’s Operations, Management, Business plans, etc.

- Drafting & Designing Offer documents, Prospectus, Statutory Advertisements &Memorandum of Association (MoA).

- Ensuring compliance with BSE, NSE, RoC& SEBI along with finalization of prospectus and RoC filling.

Post–Issue:

- Marketing Strategies for the listing company.

- Management of Escrow Accounts, Dispatch of Refunds, Finalization of Trading & Dealing of Instruments.

- Submission of final Offer Document with ROC / SEBI and Stock Exchanges, Completion of Issue and Allotment Process, Listing of Shares on Stock Exchange, etc.

- Proper Handholding after listing until migration to the main board.

Process of Listing

Pre IPO Process:

- Understand capital markets

- Understand various processes involved in raising funds through IPO

- Weigh IPO option against other options of raising funds

- If IPO, check eligibility criteria of listing on that specific SME exchange, assessing your company’s readiness

- Start processes and systems to meet the requirements of a publicly listed company

- Crystallise your project and capital raising plans

- Engage a Merchant Banker & follow the IPO process further

Post IPO Process :

- Hire a Merchant Banker (MB)

- Issue Structuring of IPO in consultation with MB

- MB prepares due diligence

- MB prepares Draft Red Herring Prospectus (DRHP) with the stock exchange

- Exchange sends their representatives for site visit on company’s premises

- Exchange calls for interview with promoter & CFO of company

- Exchange gives in principle approval to MB

- MB files prospectus (RHP) with stock exchange &Registrar of Companies (ROC)

- ROC gives approval for opening up the issue

- Issue opens & investors subscribe to the issues

- Issue closes & the stock of the shares subscribed are noted

- Company gets listed on stock exchange

- After in principle approval, MB will have 1 year to open the IPO.

- Timeline for listing: max between 3 to 4 months. From the day of signing the mandate, in next four months, the company can get listed.

Benefits Of Listing